california renters credit turbotax

You must be a California resident for the tax year youre claiming the renters credit. To claim the CA renters credit.

Best Tax Software Of 2022 Forbes Advisor

Do I qualify for CA renters credit.

. This article intends to explain some of the generalities about this particular tax credit. 120 credit if your are. Check the box Qualified renter.

The other eligibility requirements are as follows. A federal eviction ban that protected renters earlier in the pandemic has expired. To qualify for the CA renters.

California Renters Credit SOLVED by Intuit Lacerte Tax 9 Updated August 20 2021 Use Screen 53013 California Other Credits to enter information for the Renters credit. The deadline to apply for rental. Widower How to claim.

To claim the California renters credit your income must be less than 40078 if youre single or 80156 if youre filing jointly. Each state has its own regulations around a renters tax credit. Presentar la declaración de impuestos es rápido y simple con turbotax.

60 credit if you are. Arizona California Connecticut Hawaii Indiana Iowa Maine Maryland Massachusetts Michigan Minnesota Missouri New Jersey Rhode Island Vermont and Wisconsin. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

Use one of the following forms when filing. If you are Married Filing Joint the credit is 120. Your California adjusted gross income AGI is 43533 or less if your filing status is Single or Married Filing Separately or 87066 or less if you are Married Filing Jointly.

Renters Credit on TurboTax Did you pay rent for at least half of 2019 on property in California that was your principal residence is what they asked. The States that offers renters credit are as followed. TurboTax Makes It Easy To Get Your Taxes Done Right.

These states have worked out their own formulas for awarding a renters tax credit to eligible tenants. California renters credit turbotax. I am confused on what principal residence means.

Get Your Max Refund Today. In California renters who pay rent for at least half the year and make less than a certain amount currently 43533 for single filers and 87066 for married filers may be eligible for a tax credit of 60 or 120 respectively. No Tax Knowledge Needed.

For Single filer it is 60. Who gets California renters credit. Under the Provincial tab select Provincial Tax Credits Profile then make sure to check the boxes Education Property Tax Credit rent paid and the next box Manitoba School Tax Credit proceed to the next screen which allows for input of your housing information.

I rent a room in a house in CA. I am a college student filing independent. I lived on a off-campus apartment and my name is on a lease so I do pay rent.

Lacerte will determine the amount of credit based on the tax return information. 13 hours agoMany California tenants are still behind on rent payments due to the pandemic. Calculate your portion of the rent only when filling out the application.

If your State asks rent related questions while answering the TurboTax State interview questions it will cover that deduction. Residents of Manitoba who pay rent may be able to receive a credit of up to 20 of rent payments or 700 whichever is less. A simple tax return.

In the California interview look for the section called Renters Credit. Depending upon the CA main form used the output will appear on Line 46 of the Form 540 or Line 19 of Form 540 2EZ. For more information on Manitobas Education Property Tax Credit see the following links.

Renters in California may qualify for up to 120 in tax credits. AP California lawmakers on Thursday agreed to use 26 billion in federal stimulus money to pay off up to 80 of some tenants unpaid rent but only if landlords agree to forgive the rest of their debt. The renters credit was suspended for the 1993 through 1997 tax years but was reinstated effective January 1 1998 for the 1998 and all future tax years.

Go to Screen 53 Other Credits and select California Other Credits. Does California - Nonrefundable Renters Credit apply to room renting. Under California law qualified renters are allowed a nonrefundable personal income tax credit.

California Resident Income Tax Return Form 540 line 46. For example if you live in California you may qualify for a renters credit if you pay rent for your housing your income is below a certain amount and you meet other state requirements. In 2008 a 120 credit is.

Does California - Nonrefundable Renters Credit apply to room renting. Several states also provide tax relief for renters who dont meet age or disability criteria. TurboTax will ask you the qualifying questions determine if you qualify and calculate the credit for you.

You paid rent for a minimum of six months for your principal residence. Posted by 1 year ago. The credit is a flat amount and is not related to the amount of rent paid.

I have been living in CA. File your income tax return. Manitobas Education Property Tax Credit.

The 2019 earnings limits. That being said each state has its own unique set of rules and we get into these specifics below. Click continue and turbotax will correctly calculate the.

Read More. You were a resident of California for at least 6 full months during 2020. 0 Federal 0 State 0 To File offer is available for simple tax returns only with TurboTax Free Edition.

Edit pdf files on the go. California renters credit 2021 Eligible tenants whose landlords choose not to participate in the program can submit an application. In California renters who make less than a certain amount currently 41641 for single filers and 83282 for married filers may be eligible for a.

Yes California has a renters credit.

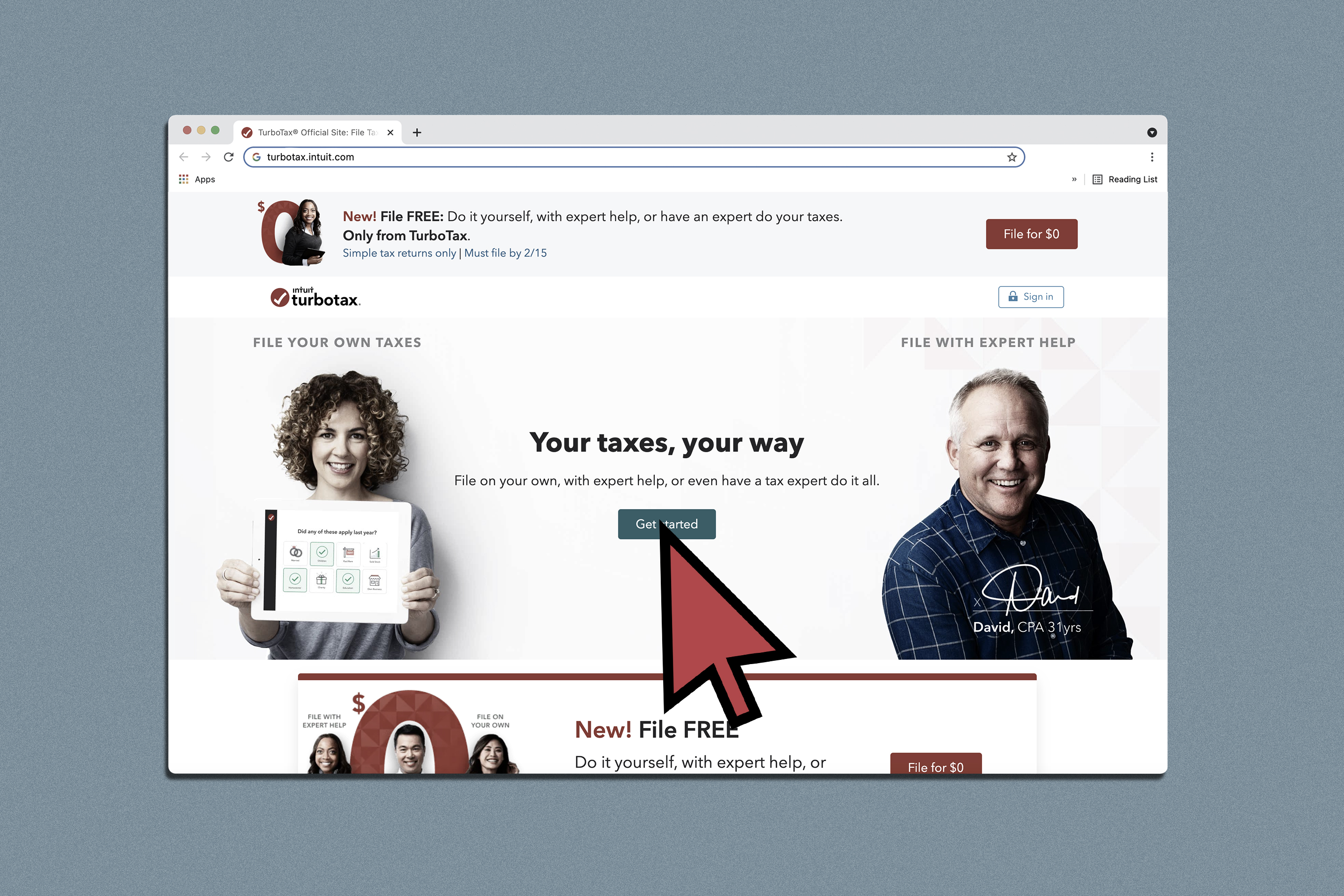

How To File Taxes For Free Turbotax 2022 Free File Change Money

Turbotax Lets You File Taxes For Free But There S A Catch Money

Quebec Property Owners Rl 31 Slips And The Solidarity Tax Credit

Claim A Tax Credit For Rent In Ontario Get Your Maximum Refund

Turbotax Review 2022 Pros And Cons

Turbotax Irs Launch Online Portal For Stimulus Check Direct Deposit

11 States That Give Renters A Tax Credit

What Is The Best Tax Software 2022 Winners

Best Tax Software Of 2022 Forbes Advisor

Best Tax Software Of 2022 Forbes Advisor

Turbotax Review 2022 Pros And Cons

I Was Almost Duped By This 40 Turbotax Fee How To Avoid It Money

Turbotax Vs H R Block Which Online Tax Service Is Best

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Claiming Expenses On Rental Properties 2022 Turbotax Canada Tips

Home Office Deductions For Self Employed And Employed Taxpayers 2022 Turbotax Canada Tips

10 Tax Tips For Airbnb Homeaway Vrbo Vacation Rentals Turbotax Tax Tips Videos Vacation Rental Homeaway Rental